This article first appeared in City & Country, The Edge Malaysia Weekly on August 12, 2024 – August 18, 2024

The lack of familiarity with a foreign property market — including pricing trends, the community in a neighbourhood and the potential for capital appreciation — can make decision-making difficult for those seeking to buy a property overseas. However, Malaysians are no strangers to the UK property market, JLL Malaysia international residential lead Chong Shu Ling tells City & Country in an email interview.

Chong says there is a difference between residents and foreign buyers in the UK. One has to meet at least one of three criteria of the automatic UK tests to qualify as a resident with a permit, which is different from citizenship.

“You may be a resident if you spend 183 or more days in the UK in a tax year, or if your only home is in the UK for 91 days or more in a row and you visit or stay in that home for at least 30 days in a tax year. Another criterion is if you work full-time in the UK for any period of 365 days and at least one day of that period is in the tax year you’re checking against.

“If you are not any of the above, you will be considered a foreign buyer. Regardless of these statuses, anyone can buy a property in the UK,” Chong explains.

So far, the UK has not set restrictions on foreign buyers, she says. They are allowed to buy properties in both the primary and secondary markets.

However, Chong cautions that the UK may have stricter regulations compared to Malaysia when it comes to selling properties there to foreign buyers. “The Anti-Money Laundering Act in the UK is stringent. Thus, purchasers must be aware that they are required by law to disclose the source of their funds to the solicitor, developer or real estate agency. Although many Malaysians find this peculiar and bothersome, it is the standard procedure in the UK.”

Imposed taxes

It should come as no surprise that foreign buyers are generally taxed more than local buyers and that is the case in the UK as well, says Chong.

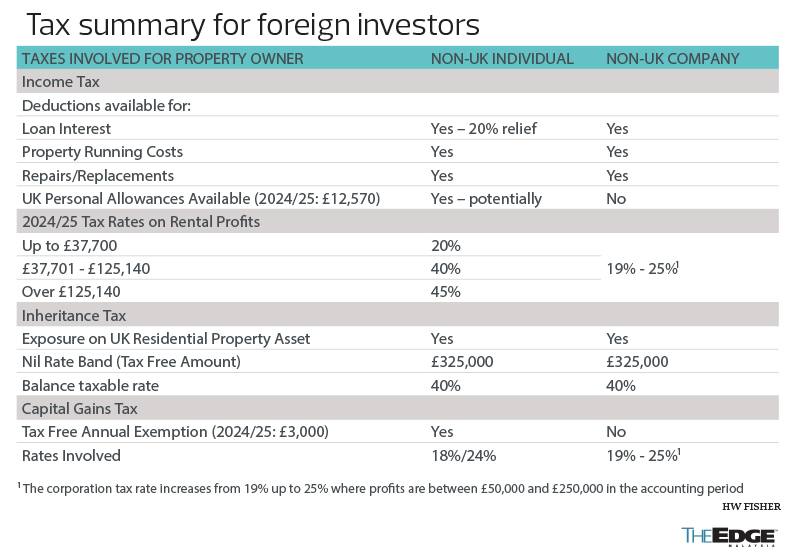

She cites HW Fisher’s UK Residential Property Tax Guide for overseas investors April 2024 report to explain the types of taxes imposed on foreign buyers.

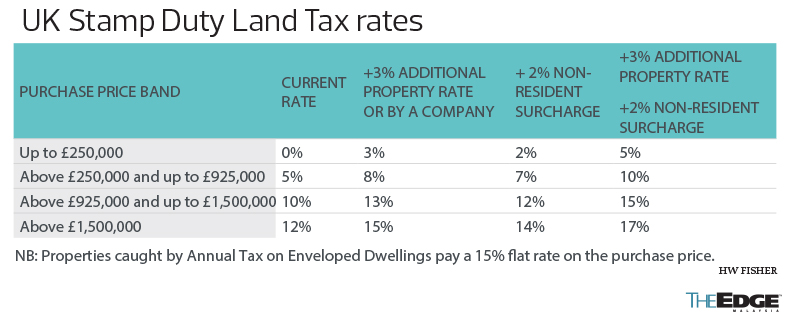

“When you buy property in the UK, you are required to pay the UK Stamp Duty Land Tax (SDLT). The amount of SDLT payable depends on the value of the property acquired. Tax relief is available for multiple purchases and local first-time buyers purchasing their main residence.”

You are also required to file your income tax if you rent out a property in the UK, says Chong. “It is payable on all net rental profit arising in the UK by individuals and trustees. It is possible to offset a variety of allowable expenses, including financing costs (subject to restrictions), maintenance and repairs, and certain professional fees. An annual tax return must be submitted through self-assessment by Jan 31 of the relevant tax year or Oct 31 if the tax return is filed in paper form.”

She adds that all British citizens, irrespective of tax residency status, are entitled to a UK personal allowance, which is the amount of tax-free income that each individual is entitled to receive.

“The following individuals are also entitled to claim the UK personal allowance: European Economic Area nationals from Belgium, Denmark, Estonia, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, Malta, the Netherlands, Norway, Portugal, Spain and Sweden as well as individuals who are residents and nationals of Thailand and Malaysia.”

When you sell your UK property, you will need to file your capital gains tax, says Chong. “The capital gains tax is reportable and payable by all individual investors on direct and indirect disposals of UK residential property within 60 days of completion.

“For non-UK residents, if they dispose of a UK property, the capital gains tax is paid on the gains in excess of the cost or the market value as at April 5, 2015, if the property was purchased before then,” she explains, adding that the UK government announced at end-2014 that gains made on sales of UK residential property by non-UK residents after April 2015 would be liable for capital gains tax.

“On indirect disposals such as the sale of shares in a company that owns a UK residential property, the rebasing date is April 5, 2019.” As announced by the government in April 2019, for disposals made on or after April 6, 2019, non-resident individuals, trustees and partnerships can be charged UK capital gains tax while non-resident companies are subject to corporation tax, she continues.

Those buying property under a company are required to pay corporation tax. “Corporation tax is payable by a UK resident company with profits under £50,000 (RM284,000) at a rate of 19%. Companies with profits greater than £250,000 pay the increased corporation tax rate of 25%. For UK resident companies, there are marginal rates of between 19% and 25% for companies with profits between £50,000 and £250,000.

“All non-UK resident companies pay corporation tax of 25%, unless they are resident in a country with a non-discrimination clause in their double tax treaty with the UK, in which case the other rates may apply.”

For background, Chong says resident companies are taxable in the UK on their worldwide profits, subject to an opt-out for non-UK permanent establishments, while non-resident companies are subject to the UK corporation tax on the trading profits attributable to a UK permanent establishment; on the trading profits attributable to a trade of dealing in or developing UK land, irrespective of whether there is a UK permanent establishment; on gains on the direct and certain indirect disposals of UK property; and on UK property rental business profits. They are also subject to tax on any other UK-sourced income.

To buy or not to buy?

Although foreigners are not restricted from purchasing property in the UK, the distance from Malaysia could lead to challenges, Chong opines.

“However, real estate law in the UK has developed to the point where engaging a reputable real estate agent can provide you with the necessary support and assistance throughout the process, which can be a great source of comfort.”

On whether Malaysians would be able to obtain loans from banks to buy property in the UK, Chong says it is possible and several options are available. “Malaysians are eligible to apply for mortgages from Maybank, CIMB and OCBC Bank. Most Malaysian banks will provide mortgages for properties located in Zones 1 to 3. Other locations will be determined on a case-by-case basis.”

For context, according to Transport for London — the government body responsible for London’s transport network — London is divided into nine “zones”, with Zone 1 being the city centre and Zone 9 being the outskirts.

On popular investment locations in the UK, Chong says, “Generally, Malaysians favour property in London’s Zones 1 and 2. However, with the relatively recent improvements on the Elizabeth Line, travel distances have been reduced and Malaysian purchasers have begun to explore options in Zones 3, 4 and 5.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.