Average property prices were said to have risen by 7.1% during the past 12 months, to stand at £238,512 – and increase of £15,794 in a year.

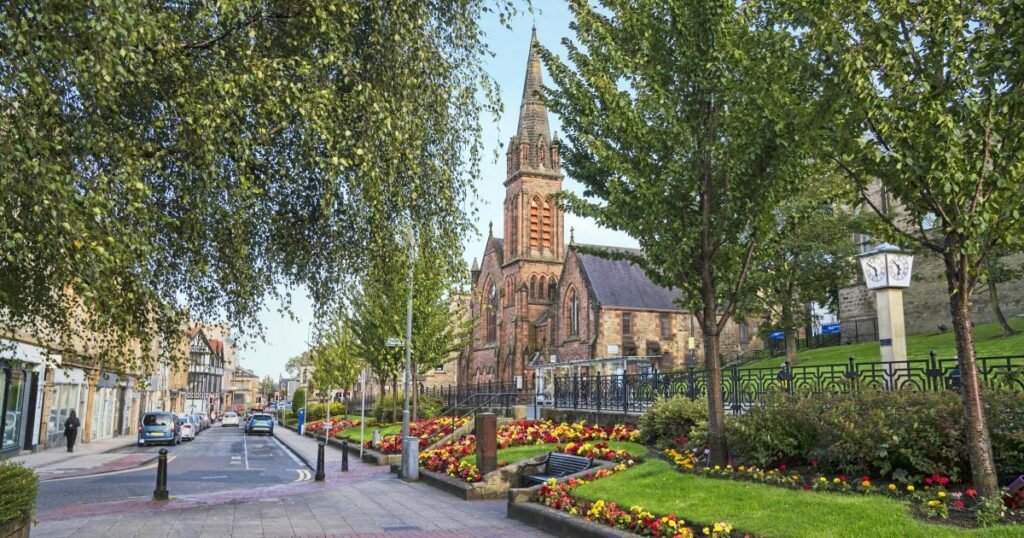

Falkirk appeared in ninth place on Lloyds list, which said that the port city of Plymouth in Devon recorded the biggest increase in house prices, with values rising by 12.6% on average.

Stafford and Wigan also recorded double-digit growth, with prices up by 12.0% and 10.5% respectively.

Wakefield, Mansfield, Woking, Liverpool, Rugby, Falkirk and Hull also made the top 10 hotspots.

Falkirk makes the list despite uncertainty over a number of jobs in the town, with major employers the Grangemouth refinery and bus maker Alexander Dennis shutting operations.

Lloyds compared the 12 months to October 2025 with the same months running to October 2024 for its research. Locations were only included where Lloyds Banking Group had made a minimum of 150 mortgage offers during the period, excluding buy-to-let and shared ownership.

On a less localised level, Lloyds said that most parts of the UK recorded growth in the value of homes in 2025.

Northern Ireland led the way with growth of 5.8%, although property values fell in London by 0.1% on average.

Amanda Bryden, head of mortgages at Lloyds, said: “Our customers’ dream homes are found in pockets around the UK and we’ve supported thousands of people to take their next home-buying step this year.

“While property prices play a role, choosing where to live is also about finding a place that feels right – a community you connect with, a commute that works for you, and a lifestyle that fits you.”

The South East dominated the locations where the value of homes fell or grew most slowly in the past year, the report said. Crawley and High Wycombe recorded the sharpest declines, with home values falling by 8.9% and 7.4% respectively.

A 6.4% fall in average property values was also recorded in Chester, but the north west of England overall recorded growth of 3.7% in property values, the report said.

Lloyds also recorded a 5.2% fall in average property values in Cardiff, despite home values rising in Wales by 2.3% generally.

Lloyds compared the 12 months to October 2025 with the same months running to October 2024 for its research.

Locations were only included where Lloyds Banking Group had made a minimum of 150 mortgage offers during the period, excluding buy-to-let and shared ownership.

On a less localised level, Lloyds said that most parts of the UK recorded growth in the value of homes in 2025.

Read More:

Northern Ireland led the way with growth of 5.8%, although property values fell in London by 0.1% on average.

Scotland’s average house price was said to be £257,399, an increase of £9,302, or 3.7%.

Ms Bryden added: “If you’ve got your heart set on a particular location, it’s worth taking time out to do some research and see what’s happening with prices there, as swings in value at a local level can make a big difference to how much you may need for a deposit, stamp duty or wider moving costs.

“If you’re open to exploring, you might find places where your money goes further. Northern regions and Scotland are still generally more affordable than the south of England, with a huge amount to offer in terms of culture and history, alongside some of the most beautiful parts of the UK countryside.”