Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

UK lenders reported a return to growth in the demand for mortgages in the first three months of 2024, according to the latest official data, providing further evidence of the property market stabilising.

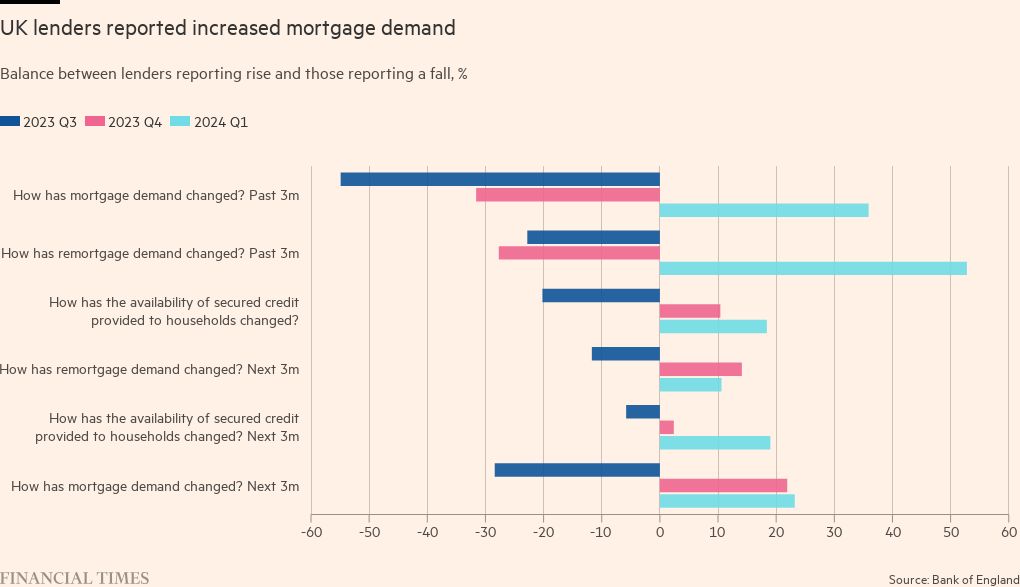

The index, which tracks the proportion of lenders reporting an increase in demand for home loans versus those reporting a decrease, rose to 35.9 in the first quarter, according to the Bank of England’s quarterly survey of banks and building societies.

This was only the second time in seven quarters that the measure was positive as it swung from minus 31.6 in the final three months of last year. The index has been volatile in recent years with the previous positive reading recorded in the second quarter of 2023.

Similarly, the BoE’s measure tracking demand expectations for the next three months rose to 23.2, the highest score in a year, while demand for remortgages was the highest in more than two years.

The findings are consistent with a recent recovery in the mortgage market after a sluggish performance last year as lenders have cut borrowing costs from their peaks.

Simon Gammon, managing partner at Knight Frank Finance, said: “Demand for mortgages to buy homes has been rising since the new year and momentum will continue to build into the summer.”

He said the housing market recovery was “still on track” despite sentiment taking a knock at the start of the year after an unexpected increase in December’s inflation data pushed mortgage rates higher.

“Many people put off moving while the economic outlook was so uncertain, but there’s a real sense now that buyers want to move on,” he added.

The BoE lenders’ survey, conducted between late February and mid-March, also found that secured credit availability to households improved at the start of the year with the index rising to 18.4 from 10.4 in the last three months of 2023. Lenders also expected availability to improve in the second quarter of this year.

“The easing in credit conditions for secured lending is supporting the economic recovery, which may lead to stronger growth than the Monetary Policy Committee expects,” said Tomasz Wieladek, economist at investment company T Rowe Price.

But the BoE survey found lenders reporting an increase in mortgage defaults and expectations of a further rise in the second quarter. The index tracking expected default over the next three months stood at 34.2, a slight fall on the previous quarter and the lowest in more than one year.

Wieladek said the continued rise in defaults was “likely an overhang from the mortgage payment issues that started during the pandemic and the recent rise in mortgage rates in the UK”.

He added that the MPC would not put “much weight on it” and he expected defaults to fall in the near term “given the economic recovery, the tight labour market and rising real wages”.

There has been some volatility in recent property market data. Figures out earlier this month from Nationwide and Halifax showed an unexpected drop in house prices in March after the rise in mortgage rates in January.

This contrasts with recent BoE data that showed mortgage approvals rose to a 17-month high in February. Estate agents were also more optimistic about housing demand in March, according to the latest survey by the Royal Institution of Chartered Surveyors.