When euphoria over finding the British oil and gas sector’s Achilles heel wears off, the ball and chain of handicapped upstream investment reality start to set in, and job loss goes up, flashing lights signaling energy security endangerment will come on, enabling another potential cost of living crisis to set in. How can the UK avoid this scenario despite the planned windfall tax hike and put all the puzzle pieces together to cultivate a sweet spot against an uncertainty-ridden backdrop of energy investment in the North Sea? Which road should it take to enable projects to flourish, setting clean energy growth ablaze without hampering oil and gas development and forcing it to shut down prematurely with no backup to take over the power generation torch in sight?

The nuts and bolts behind the Labour Party’s green power quest within the offshore energy arena are no secret, given its zest to turn the UK into a clean energy superpower, which carries a hefty price tag it plans to bankroll with windfall taxes collected from fossil fuels. What are the missing pieces from the government’s plan to raise the Energy Profits Levy (EPL) once again and extend its sunset clause?

While many have claimed to be caught by surprise after Labour disclosed its intention to extend the windfall tax on UK oil and gas producers if we look at the party’s manifesto and some of the proposals and promises they made even before being elected to the government, we can see the current situation is not a novel proposal since the party said at the start of the year that it would raise the current 75% tax to 78% until 2029.

Even the decision to keep the EPL in place for another year, until 2030, did not come out of the blue and was a logical step that one could foresee as a result of ambitions to turbocharge clean energy, mitigate the rising effects of climate change, and respond to growing calls from climate and environmental organizations to start cutting down on the use of fossil fuels.

Since the erosion of energy producers’ investment confidence in the UK has become more pronounced in recent years, many have pointed out the knock-on damaging impact of the Energy Profits Levy and other economic factors. The tax hike is said to have affected decommissioning progress, as the cost of shutting down old installations is not treated as an allowable expense.

Even though climate and environmental activists have been claiming for years that new oil and gas production in UK waters will prevent Britain from reaching net zero by 2050, an analysis from the North Sea Transition Authority (NSTA) in July 2023 showed that the carbon footprint of domestic gas production was around one-quarter of the carbon footprint of imported LNG. This is perceived to be an important argument for maintaining domestic production, considering that 75% of the UK’s energy needs are met by oil and gas.

There is no denying the great ambition behind Labour’s plans to secure carbon-free green energy to make Britain a clean energy superpower by 2030, through various endeavors, including setting up Great British Energy, a publicly owned clean-power company focused on boosting energy security, creating jobs, and building supply chains across the UK.

However, Labour seems to be ignoring the big elephant in the energy transition room which stands for the fact that many of the players producing the hydrocarbons for which it wants to turn off the taps are the same companies spearheading the expansion of renewable and low-emission offshore energies, including offshore wind, hydrogen, marine energy, and the development of carbon capture and storage (CCS).

Acknowledging this aspect may make it easier to understand the fears over the windfall tax extension’s potential to damage the overall investment case for projects across the North Sea, which serve as building blocks of the energy transition’s net zero blueprint and sustainable energy future.

With this at the forefront, Labour’s proposals have once again sparked the ire of Britain’s oil and gas industry, reminiscent of the barrage of criticism the party faced a few months ago and last year over its plans to ban all new oil and gas developments in the North Sea.

The drive behind the fierce opposition to such political proposals stems from the view that this move is likely to dry up investment flows, causing the economy to falter with a spillover of damaging effects on jobs across the country, which are said to be needed to deliver “a homegrown energy transition while continuing to support the country’s energy needs today,” according to Offshore Energy UK (OEUK).

Green vs. black gold tendrils in UK’s energy arsenal poles apart

The opinions over Labour’s plans showcase a deep divide between those who want to embrace all things green in the energy mix and those who advise a more cautious approach to net zero demands, propagating a balanced approach to the energy transition journey, which in their view needs to be made with all domestic energy sources, without leaving any behind.

This gap feeds the hovering uncertainty in the energy sector until it becomes a looming specter of the economic upheaval likely to sweep across the North Sea energy industry if the party crosses off the critical allowances that enable companies to make long-term investments in domestic production. The Energy Profits Levy reform is expected to spur a rise in the rate of the EPL to 38% from November 2024 and extend the tax from March 2029 to March 2030.

The government plans to do away with the windfall tax’s “unjustifiably generous investment allowances” by abolishing the levy’s main 29% investment allowance for qualifying expenditure and reducing the extent to which capital allowances could be taken into account when calculating levy profits.

James Murray, UK Exchequer Secretary to the Treasury (Labour), outlined: “The Energy Security Investment Mechanism will remain, helping to provide operators and their investors with confidence the levy will no longer apply if prices fall to, or below, historically normal levels for a sustained period. The government will also remove unjustifiably generous investment allowances from the EPL, including by abolishing the levy’s core investment allowance.

“Further details on the government’s approach to all allowances in the EPL will be set out at the Budget. The government recognises the importance of providing the oil and gas industry with long-term certainty on taxation after a period of change. The government will therefore set out a way of working with the industry and others to develop an approach for responding to price shocks after the EPL ceases.”

Tax hike puts energy industry in danger of five-year investment paralysis

The global oil and gas industry, especially the one with strongholds and operations in Europe, is well-versed in greenhouse gas (GHG) emission cuts and has been picking off low-hanging decarbonization fruits first while also working its way up the emissions reduction ladder to make the fossil fuel engine less carbon-intensive and even carbon neutral.

While warning that changes to the profits levy could “sound the death knell” for the North Sea energy industry, Wood Mackenzie emphasized the amendments’ potential to paralyze investment for five years. The finer points of the tweaks to critical allowances, are yet to be revealed, however, the government thinks the EPL changes are an opportunity to bring in an annual average revenue of £1.2 billion ($1.54 billion), or £6 billion ($7.68 billion) over the next parliament.

Graham Kellas, Senior Vice President of Global Fiscal Research at Wood Mackenzie, remarked: “After less than a month in power, the Labour government has continued in the same vein as the previous Tory government by making further temporary changes to the upstream tax system without addressing the uncertainty over the critical capital allowances. The short-term gains of tweaking the EPL could result in the premature slowdown of investment across the upstream sector which could lead to accelerated cessation of production.”

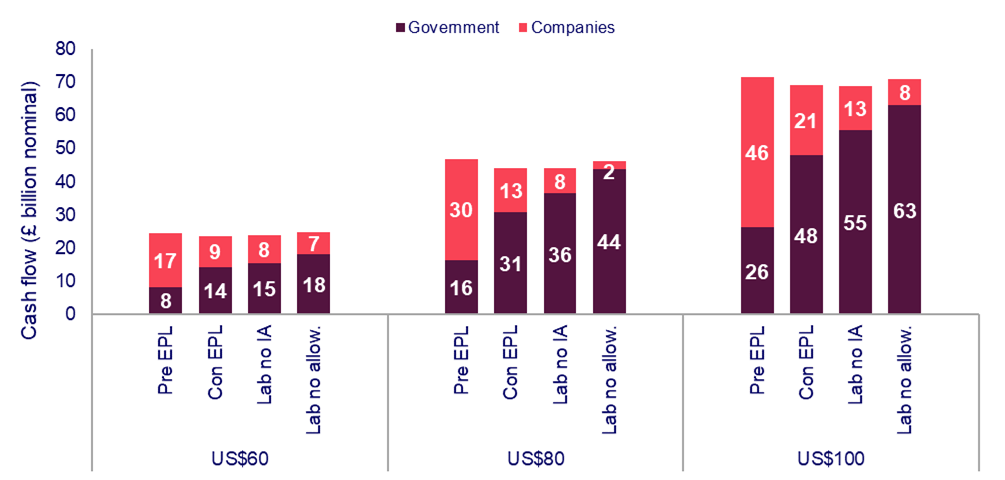

Government and company cash flows: 2025-2029

Many project developments have been pushed back, delaying previously set timelines, and multiple companies have either downsized or sold their entire oil and gas portfolios in the North Sea since the original windfall tax was introduced. A recent announcement, confirming Shell and ExxonMobil are selling 100% of their working interest in the UK Southern North Sea assets to Viaro Energy’s RockRose Energy, is a case in point.

Furthermore, Wood Mackenzie elaborates on the wave of surprise that followed the extension of the sunset clause to 2030, claiming that this arose due to Labour’s previous promise to keep its version of the EPL for the duration of the parliament term which will end in 2029.

As a result, the decision to extend the sunset clause to 2030 makes little sense to the energy market intelligence provider, which notes that such a move retains one of the EPL’s critical flaws – the misalignment of fiscal terms between the investment phase and the producing counterpart.

James Reid, Senior Research Analyst at Wood Mackenzie , underscored: “The sunset date has extended so often investors will now pragmatically assume that the EPL is a permanent feature of the system, rather than assuming terms become more favourable in the future.”

In a nutshell, the increase in the Energy Profit Levy takes the headline tax rate for the oil and gas sector to 78%, further extends the levy to March 2030, removes the EPL’s investment allowance, and signals further cuts in capital allowances while keeping the decarbonization allowance and the levy’s price floor – the Energy Security Investment Mechanism –in place.

Following the announced changes to the windfall tax, Jersey Oil & Gas has underlined that the Greater Buchan Area (GBA) joint venture will carefully consider the tax changes’ impact on the economics of the NEO Energy-operated Buchan development and final investment decision (FID).

The company also explains that the full implications will only be clear when the level of capital allowance claims available as deductions to the EPL are provided in the October Budget. A 2017-built FPSO, selected to work on this project, is expected to spend up to a year in Scapa Flow. The start-up of production from the project was recently bumped to late 2027.

While providing his take on the windfall tax hike, David Whitehouse, Offshore Energies UK ‘s Chief Executive, stressed: “This is not partnership working between government and industry. These announcements have been made without meaningful engagement with this sector. We recognise the government has significant spending challenges to manage but today’s announcement will only serve to rock confidence further.

“The offshore energy sector supports over 200,000 jobs. These are real people, working in our energy industry today. Today’s announcement jeopardises jobs in communities across the UK. This is something the Prime Minister committed in his manifesto not to do. Announcements like this without engagement is no way to treat these hard-working people.”

Picking up green threads to connect subsea electricity superhighways

As hunger pangs for green energy ratchet up, high-voltage subsea cable links have emerged as top contenders on the list of projects, technologies, and tools enabling faster decarbonization and enriching the energy mix with more clean power. The subsea electricity interconnectors have the potential to power millions of homes.

The UK government has recognized the vast potential of such projects to utilize the green power harnessed from the North Sea’s offshore wind, floating solar, and marine energy offerings to boost clean energy’s import and export capacity. This, in turn, has brought about a step-up in the pursuit of subsea interconnectors.

A few months ago, Britain’s energy regulator, Office of Gas and Electricity Markets (Ofgem), recommended approval of plans for two high-voltage subsea cable links to Europe. The first is the Tarchon Energy interconnector for a direct power link between Germany and Great Britain through a 1.4 GW 610 km cable to provide 1.4 GW of electricity capacity.

The second one is the LionLink, said to be a first-of-its-kind offshore hybrid asset (OHA) electricity link to connect the British and Dutch power grids, plugging the country’s grid directly to Dutch wind farms in the North Sea and providing 1.8 GW of electricity capacity.

Last July, the UK regulator granted final approval for SSEN Transmission’s plans to provide a subsea electricity transmission link to Orkney. Great Britain has 11.7 GW of interconnection capacity already in operation or under construction and LionLink and Tarchon could add a further 3.2 GW capacity.

National Grid, which plans to invest £60 billion (close to $76.5 billion) in energy projects from 2024-29 on both sides of the Atlantic, is moving forward with two multibillion-dollar HVDC cable connections in the UK, known as the Eastern Green Link 1 (EGL1) and Eastern Green Link 2 (EGL2) projects.

These electricity superhighway hubs are envisioned to enable Britain to bolster the security of energy supplies while also contributing to the country’s net zero targets, supporting the UK’s 50 GW offshore wind power by 2030 goal. A few months ago, the 1.4 GW Viking Link, described as the world’s longest subsea interconnector, was launched to connect the UK and Denmark.

In May 2024, the first-ever energy link between the UK and Germany, the €2.8 billion NeuConnect interconnector, marked a new milestone with the start of construction works on the German side of the project, ten months after work had begun in the UK.

The United Kingdom’s renewable energy arsenal is set to be enlarged with Xlinks’ Morocco-UK power project through the installation of high-voltage direct current subsea cables for the supply of 3.6 GW of clean power to deliver 8% of Britain’s current electricity needs – or the equivalent of powering 7 million homes.

The project entails a new electricity generation facility powered by solar and wind energy, alongside a battery storage facility to provide affordable, reliable, clean energy from Morocco to Britain within a decade. All these subsea power links enable the UK to weave new and intricate green energy threads with other, mostly North Sea countries.

Despite being still in its infancy with 10-15 years estimated to be required for its development, one of the biggest and most complex interconnector undertakings ever proposed to date certainly understands what it means to dream big and set the bar high, as the proposed multibillion-dollar 6 GW North Atlantic Transmission One–Link (NATO-L) project does not lack ambition.

With the vision of bringing additional carbon-free power to Europe, subsea cables will spread across the Atlantic to link North America and Western Europe. If the project goes ahead, the UK and Europe are poised to up their diversification and security of supply ante with decarbonized power in line with the continent’s transition to a net zero economy.

Moreover, North America will get a shot at developing the green potential of the Northeastern corner of the American continent with hydro and wind. NATO-L provides NATO with a golden opportunity to forge a physical link between its two blocks and bolster energy security amongst its members on both sides of the Atlantic.

Aside from power interconnectors, Britain is also pursuing electrification via offshore wind farms. One such project, being developed by Flotation Energy and Vårgrønn, is the floating offshore wind project, Green Volt, which will enable electrification and decarbonization of oil and gas platforms while delivering power to the UK grid, benefitting UK consumers and industry.

The project recently got all its planning approvals out of the way, thus, it remains on track to be the first commercial-scale floating offshore wind farm in Europe with up to 35 floating wind turbines.

The company behind the Nemo Link subsea electricity interconnector between the UK and Belgium has welcomed the recent Energy UK’s report: ‘Mission Possible: The steps to make Britain a clean energy superpower,’ concerning closer UK-EU cooperation on energy and climate.

However, Nemo Link Limited (NLL) underlines the EU Carbon Border Adjustment Mechanism (CBAM) in its current form has the potential to create “a very significant trade barrier” for electricity imports into the EU, irrespective of equivalent carbon prices in exporting third countries. This would negatively impact all dimensions of the energy trilemma.

“We also welcome Energy UK’s view on the need for greater cooperation between the UK and EU and the importance for restoring efficient electricity trading. Moving to more efficient trade by prioritising the UK-EU electricity trading arrangements workstreams will ensure the UK can speed up the transition to clean power by 2030,” underlined Nemo Link.

The UK seems to have many energy plays at its disposal, ranging from traditional oil, gas, and liquified natural gas (LNG) ones to renewables like offshore wind and solar, alongside emerging low-carbon technologies.

Even though these opportunities paint a promising picture of the country’s future energy developments, the constant shifts in energy policy, political uncertainty, global security concerns, geopolitical tensions, and rising costs hamper the British energy industry’s ability to address energy transition challenges.

With beliefs buttressed by energy security challenges and the memory of the global energy crisis still fresh, proponents of a balancing act, want to see all those fifty shades of green energy pursuits in action alongside open season on domestic oil, gas, and LNG plays, as they are convinced this is the best recipe to come to grips with the triple whammy of energy security, affordability, and sustainability.

ADVERTISE ON OFFSHORE ENERGY

𝐃𝐨 𝐲𝐨𝐮 𝐰𝐚𝐧𝐭 𝐭𝐨 𝐠𝐫𝐚𝐛 𝐭𝐡𝐞 𝐚𝐭𝐭𝐞𝐧𝐭𝐢𝐨𝐧 𝐨𝐟 𝐲𝐨𝐮𝐫 𝐭𝐚𝐫𝐠𝐞𝐭 𝐚𝐮𝐝𝐢𝐞𝐧𝐜𝐞 𝐢𝐧 𝐨𝐧𝐞 𝐦𝐨𝐯𝐞? 𝐋𝐨𝐨𝐤 𝐧𝐨 𝐟𝐮𝐫𝐭𝐡𝐞𝐫 𝐭𝐡𝐚𝐧 𝐎𝐟𝐟𝐬𝐡𝐨𝐫𝐞 𝐄𝐧𝐞𝐫𝐠𝐲! 𝐎𝐮𝐫 𝐜𝐨𝐧𝐭𝐞𝐧𝐭 𝐢𝐬 𝐫𝐞𝐚𝐝 𝐛𝐲 𝐭𝐡𝐨𝐮𝐬𝐚𝐧𝐝𝐬 𝐨𝐟 𝐩𝐫𝐨𝐟𝐞𝐬𝐬𝐢𝐨𝐧𝐚𝐥𝐬 𝐞𝐧𝐠𝐚𝐠𝐞𝐝 𝐢𝐧 𝐨𝐢𝐥 & 𝐠𝐚𝐬, 𝐦𝐚𝐫𝐢𝐭𝐢𝐦𝐞, 𝐨𝐟𝐟𝐬𝐡𝐨𝐫𝐞 𝐰𝐢𝐧𝐝, 𝐠𝐫𝐞𝐞𝐧 𝐦𝐚𝐫𝐢𝐧𝐞, 𝐡𝐲𝐝𝐫𝐨𝐠𝐞𝐧, 𝐬𝐮𝐛𝐬𝐞𝐚, 𝐦𝐚𝐫𝐢𝐧𝐞 𝐞𝐧𝐞𝐫𝐠𝐲, 𝐚𝐥𝐭𝐞𝐫𝐧𝐚𝐭𝐢𝐯𝐞 𝐟𝐮𝐞𝐥𝐬, 𝐬𝐡𝐢𝐩𝐩𝐢𝐧𝐠, 𝐚𝐧𝐝 𝐨𝐭𝐡𝐞𝐫 𝐢𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞𝐬 𝐨𝐧 𝐚 𝐝𝐚𝐢𝐥𝐲 𝐛𝐚𝐬𝐢𝐬.

Follow Offshore Energy’s Fossil Energy market on social media channels: