Currency risk takes a bite when investing in India, says India Capital Growth’s Narain.

Investing in emerging markets has always meant taking on more risk, whether it be from geopolitics, different economies or currencies.

That’s also true for India, where perceived geopolitical risks include the outcome of the ongoing elections, its relationship with Russia and environmental, sustainability and governance (ESG) issues.

At the same time investors also need to think about currency, according to Gaurav Narain, manager of the India Capital Growth trust, who said they must be willing to take an average hit of 2% to 3% every year before they can break even.

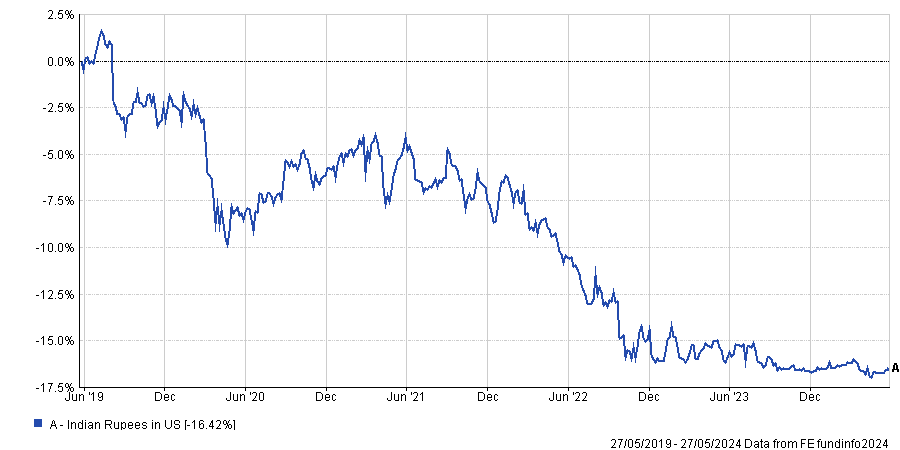

The Indian Rupee has been volatile in recent years. Over 12 months it is 4% lower against the pound while over five years this rises to 17%.

Against the dollar the figures are comparable. Over one year the Rupee is just 0.7% weaker, but this climbs to 16.4% over five years and 29% over 10 years. And this depreciation might not be reversing any time soon, although it should slow down.

Rupee versus US dollar over the past 5 years

Source: FE Analytics

“Historically, the currency has depreciated between 3% to 3.5% on average every year over the past five, 10 and15 years against the dollar”, Narain said. “But my own sense is that now it will be slightly less, around 2% to 3%.”

There are three main reasons why the manager is expecting a lower depreciation trend going forward.

Firstly, the export of services is now worth $340bn and also growing at a much faster pace than before. Secondly, India is getting a lot of forex reserves in the form of remittances, last year that amounted to about $110bn. And thirdly, India is attracting a lot of foreign direct investment, almost $60-$70bn a year.

“In particular, the result of the forex reserves are very strong and provides a lot of cushion on the currency. In volatile times, the Reserve Bank of India has a lot of flexibility, so you shouldn’t see the big swings that have historically happened,” explained the manager.

“The currency has been remarkably stable against the dollar and the country is in a much better position. But if you’re investing in India you must account for that 2%-3% hit.”

The other risk that has been very present on investors’ minds recently is the election, with results to be announced next week. The current prime minister Narendra Modi is expected to maintain his majority, which is good news for investors, as he is “very good for the market”, according to Narain.

“He is doing all the right things for the economy. He’s thinking long term, trying to eliminate corruption and is very strong on execution, so he’s genuinely good for the economy,” he said.

On top of that, has been doing an “incredible balancing act” on the international arena, remaining friendly with the Western world while still purchasing oil from Russia.

“India is among the top-three oil purchasers in the world, mainly from the Middle East and the US, but also Russia. Imagine what would happen to oil prices if the country stopped buying from Russia,” Narain said.

While Modi is the favourite candidate, election results are hard to predict. If he loses his majority, the market will “definitely correct”, said Narain, at least in the short term, because of the uncertainty.

“But then it all boils down to what the new government does on policies,” he said. “India is a democracy and has policy continuity, you don’t see someone come in and change policies completely. Which is why India over the last two decades has grown at 10% in nominal GDP in dollar terms.”

Another potential issue for investors is that the market is trading on particularly high multiples, given the substantial growth that’s recognised and already priced in by the market.

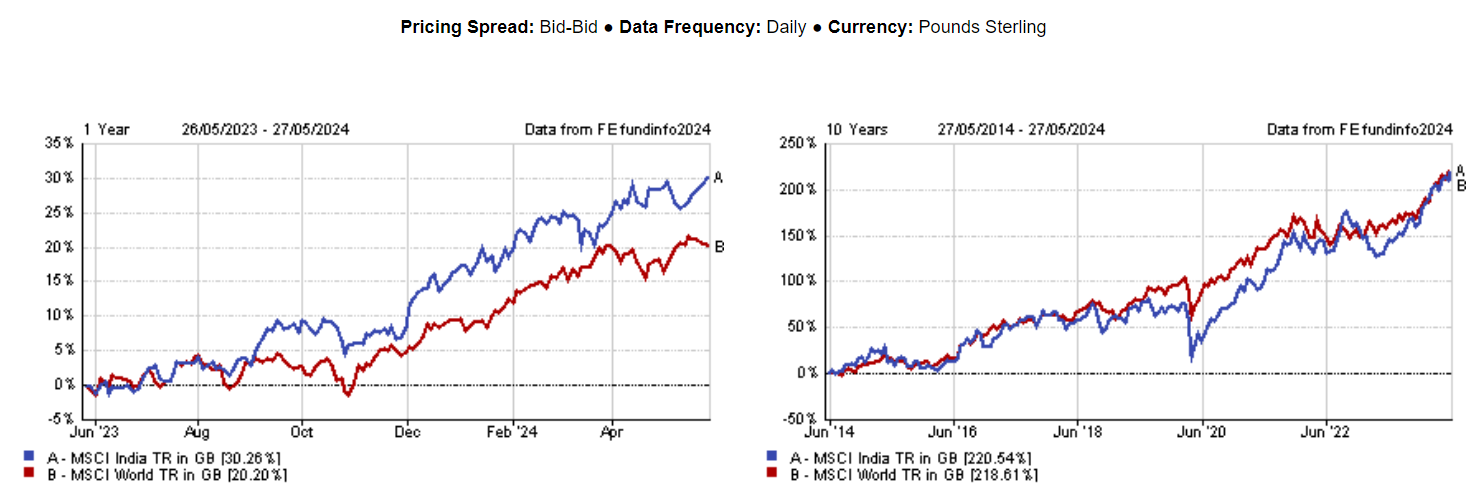

The average IA India fund has grown by 9.5% so far this year and the country has delivered strong returns for much of the past decade.

Performance of indices over the past 12 months and 10 years

Source: FE Analytics

The India Capital Growth fund has been tops amongst its IT India/Indian Subcontinent peers over the past 10 years. It mainly focuses on mid- and small-caps, which make up 38% and 50% of the portfolio, respectively.