Refresh

Rachel Reeves: “More to do to ease the cost of living”

Responding to this morning’s report, Reeves said: “We have taken the decisions needed to stabilise the public finances, and we’re a long way from the double-digit inflation we saw under the previous government, but there’s more to do to ease the cost of living.

“That’s why we’ve raised the minimum wage, extended the £3 bus fare cap, expanded free school meals to over half a million more children, and are rolling out free breakfast clubs for every child in the country. Through our Plan for Change we’re going further and faster to put more money in people’s pockets.”

(Image credit: Jacob King – WPA Pool / Getty Images)

Transport costs up 3.2% as airfares took off

Airfares jumped by 30.2% on a monthly basis – the largest July increase since records began in 2001.

(Image credit: Witthaya Prasongsin via Getty Images)

What drove the inflation jump?

Commenting earlier this week, Sanjay Raja, Deutsche Bank’s chief UK economist, said: “There’s likely to be more upside in services momentum, particularly around airfares and accommodation prices, with the former supported by the timing of school holidays and the latter potentially flattered by an Oasis-related bump higher.”

Patience could be required from investors when it comes to inflation

Although investors won’t be delighted if inflation jumps again this morning, patience could be required, according to Michael Field, chief equity strategist at investment firm Morningstar.

“Economists have previously warned that we could be dealing with elevated levels of inflation for a transitory period,” he said.

“We believe this is how the Bank of England will view the situation when making upcoming decisions on interest rate levels. Interest rates in the UK are the highest in the western world, so the bank has plenty of room for manoeuvre, even with elevated inflation in the short term.”

Field points out that UK equity markets are trading at all time-highs. “While inflation remains somewhat concerning, the effect of lower interest rates feeding through the economy should only add weight to investor confidence.”

(Image credit: Xavier Lorenzo voa Getty Images)

Welcome back – 15 minutes to go

Good morning and welcome back to our live report. In 15 minutes, the Office for National Statistics (ONS) will publish July’s inflation figure. It is expected to show another jump to 3.8%, which would be the highest reading since January 2024.

(Image credit: Craig Hastings via Getty Images)

Join us tomorrow morning

- The rate of inflation is expected to jump again tomorrow, potentially hitting 3.8%.

- This would mark a 0.2 percentage-point increase compared to June’s reading of 3.6%.

- Summer spending could be partly responsible for the rise, including higher airfares and accommodation prices. Food prices have also been adding pressure in recent months, and this trend could continue in tomorrow’s report.

The Bank of England will also be keeping a close eye on core and services inflation to get a sense of how embedded inflationary pressures are in the economy:

- Core inflation strips out categories that tend to see short, sharp fluctuations in prices, like food and energy.

- Services inflation covers things like hotel stays, airfares, educational costs and more. Services make up around 80% of the UK economy, so this is an important measure.

- Core inflation is expected to hold steady at around 3.7% tomorrow, according to Deutsche Bank, while services inflation could creep up to 4.9% (compared to 4.7% in June).

All of this has important implications for household budgets and the Bank of England’s interest rate decisions – which in turn impact things like savings rates and mortgage rates. Join us tomorrow as we share the latest news and analysis.

How are investors responding to rising inflation?

“While rate cuts should disincentivise saving, rising inflation and the prospect of further tax rises in the autumn are forcing investors to exercise a degree of caution. With economic growth slowing to 0.3% between April and June, policymakers must reassure investors and boost confidence in the economy in order to unlock growth,” he said.

“There are undoubtedly opportunities in interest rate sensitive sectors and UK equities, but we are seeing investors adopt a patient, disciplined approach with a focus on long-term returns.”

(Image credit: Karl Hendon via Getty Images)

Rising inflation worsens the impact of fiscal drag

Inflation also erodes the value of the tax-free personal allowance – the amount of income you do not need to pay tax on. This has been frozen at £12,570 since 2021.

“Frozen tax thresholds affect everyone. With the personal allowance and higher-rate threshold frozen until 2028, this means that even lower earners will gradually pay tax on more of their income,” said Craig Rickman, personal finance expert at Interactive Investor.

“The noise around fiscal drag is likely to crank up over the coming months as the Autumn Budget heaves into sight. With the government at risk of missing its narrow, iron-clad fiscal rules, tax hikes could be in the offing.”

Rickman added that extending the freeze on tax thresholds beyond 2028 is “a way for the government to raise billions of pounds without technically breaking its manifesto promise not to raise taxes on working people”.

(Image credit: Peter Dazeley via Getty Images)

Can investing help you beat inflation?

There are some caveats – for example, you should be willing to keep the money invested for a minimum of five years to ride out short-term volatility. Before investing, you should also make sure you have paid off any high-interest debts and put aside enough cash to cover emergencies and any short-term savings goals.

It is important to invest sensibly across a diversified range of opportunities rather than putting all of your eggs in one basket. If you don’t feel confident picking your own investments, a ready-made fund could be a good option.

Our beginner’s guide shares some useful tips for those who are thinking about investing for the first time.

(Image credit: Alistair Berg via Getty Images)

What would another inflation jump mean for savers?

Rising inflation is bad news for those with cash savings, particularly when coupled with interest rate cuts. Inflation erodes the real value of cash, as the pound in your pocket doesn’t go so far when the cost of goods and services goes up.

(Image credit: PM Images via Getty Images)

What does rising inflation mean for your money?

At the basic level, rising prices means the cost of everyday goods and services is going up, stretching household budgets. This could prove challenging if your income isn’t rising at the same pace.

“While workers may take comfort in the fact that pre-tax incomes are still growing faster than inflation for now… this is offset by a heavier tax burden and the risk that wage growth could slow further from here,” said Alice Haine, personal finance analyst at investment platform Bestinvest.

“With uncertainty around the timing of future rate cuts and businesses adopting more cautious hiring strategies – or turning to AI to plug skills gaps – consumers would be wise to adopt a prudent approach to expenditure,” she added.

(Image credit: SolStock via Getty Images)

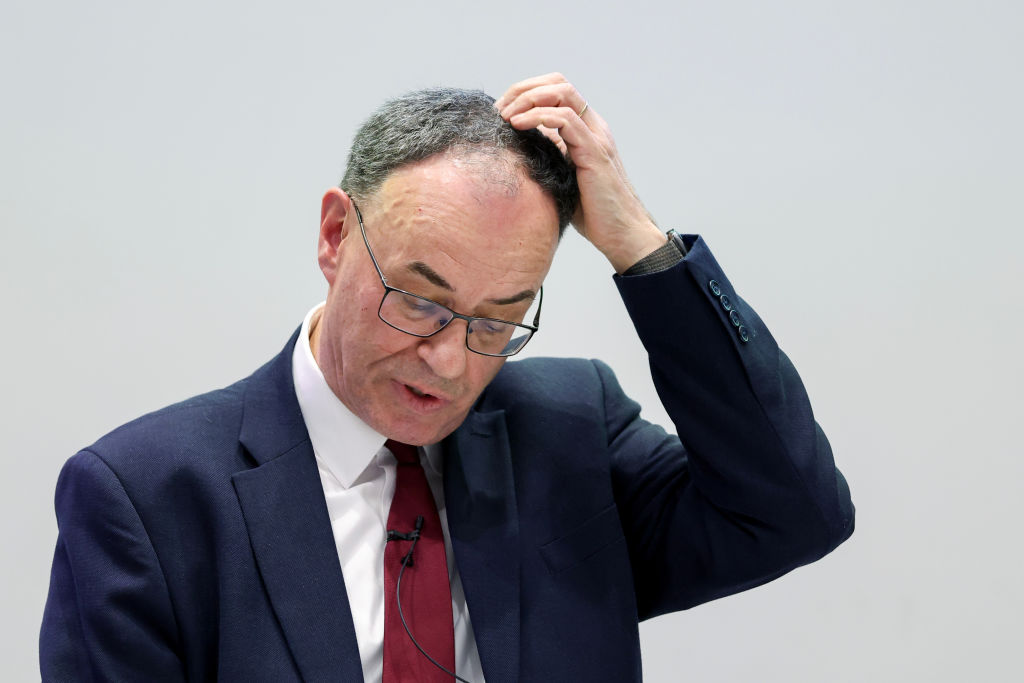

Inflation “much hotter than government and Bank of England would like”

Although inflation has slowed considerably from its peak of 11.1% in October 2022, it remains elevated. Victoria Scholar, head of investment at the platform Interactive Investor, points out that it is “much hotter” than both chancellor Rachel Reeves and the Bank of England would like.

This was reflected at the Bank’s latest rate-setting meeting, when policymakers voted to cut rates by a narrow 5-4 majority. Two votes were required before that verdict was reached. Commentators had been expecting a more decisive vote and, as a result, some have dialled down the tone of their forecasts going forward.

“Although we still expect another 25 basis-point cut in November, our call is made with much less confidence,” said Andrew Goodwin, chief UK economist at Oxford Economics.

“We think it wouldn’t take much to convince the committee to pause for longer before cutting again. If inflation continues to surprise to the upside, this could tip the balance towards no change, particularly if market pricing moves against a rate cut.”

Governor of the Bank of England, Andrew Bailey

(Image credit: Photographer: Darren Staples/Bloomberg via Getty Images)

What’s driving price increases?

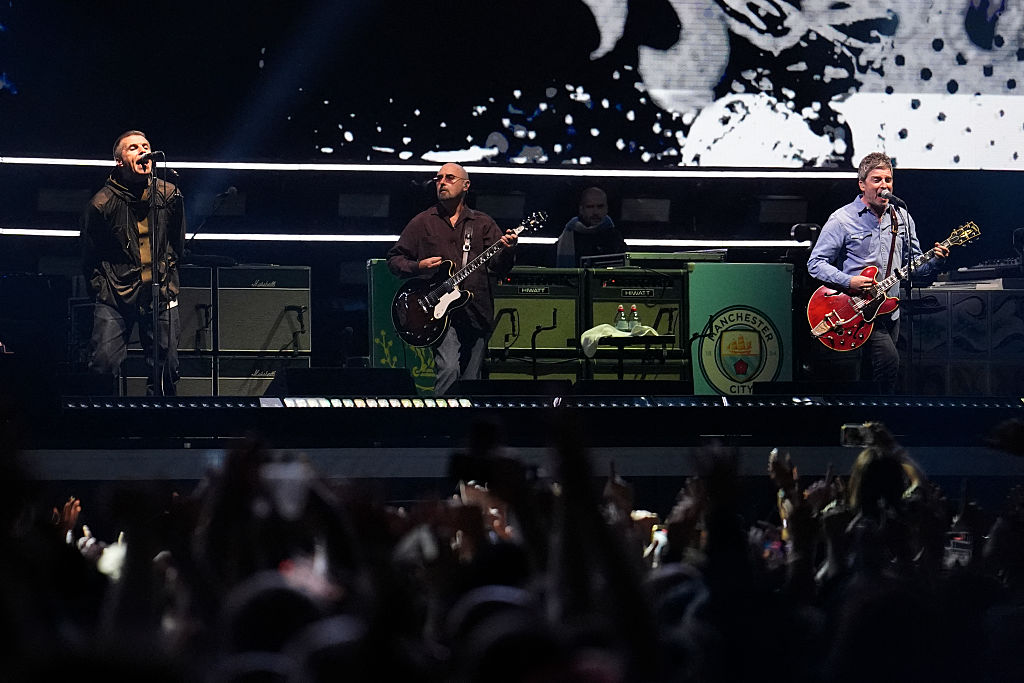

“There’s likely to be more upside in services momentum, particularly around airfares and accommodation prices, with the former supported by the timing of school holidays and the latter potentially flattered by an Oasis-related bump higher,” said Sanjay Raja, chief UK economist at Deutsche Bank.

“We expect food inflation to continue its ascent – but we do think we may be nearing the peak,” Raja said.

Deutsche Bank thinks the Oasis reunion tour may have contributed to higher accommodation prices in July.

(Image credit: Photo by AFP STRINGER / AFP via Getty Images)

What to expect from tomorrow’s inflation report

Households should brace themselves for another jump when July’s inflation report is published at 7.00am tomorrow. The Bank of England expects the headline inflation figure to jump to 3.8%, up from 3.6% in June.

Economists at Deutsche Bank are also expecting a 0.2 percentage-point jump compared to last month’s reading. Meanwhile, research firm Pantheon Macroeconomics is expecting a slightly smaller increase, bringing inflation to 3.7%.

After briefly returning to the Bank of England’s 2% target last year, inflation has been rising in recent months.

(Image credit: Malte Mueller via Getty Images)