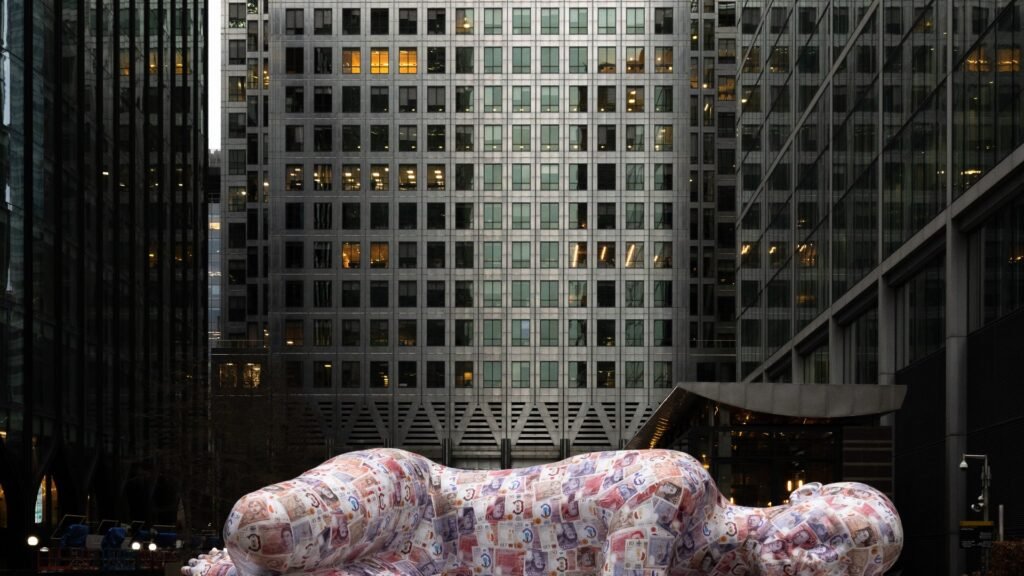

A ‘GIANT’ made up two thousand fake bank notes has appeared in Canary Wharf – in a warning to Brits about ‘sleeping savings’.

Made from recycled polystyrene and weighing more than a ton, the installation was created to highlight that more than £1.3 trillion of UK savings is sitting in low interest savings accounts earning less than 50 per cent of the Bank of England base rate.

The fully recyclable ‘sleeping giant’, designed by savings platform Flagstone, measures almost eight metres in length and is four metres high, and will rest in the capital’s financial district for three days.

It comes after research from the brand revealed 48 per cent of those with a savings account couldn’t tell you what the interest rate is on it.

And 29 per cent have used the same low interest savings account for more than 11 years.

A spokesperson said: “Over £1.3tn in UK cash is currently languishing in low-interest accounts – with this sculpture, we wanted to capture the scale of that problem.

“People are busier than ever, so it’s understandable that their savings aren’t always front of mind.

“But a little work goes a long way; millions of savers could be earning double what they are today.

“The first step is staying informed – knowing your interest rate and knowing where to look for better options.”

The study also found 15 per cent of adults spent just ‘minutes’ assessing their options before setting up their last savings account.

And 12 per cent who have cash in savings rarely or never check the progress of what’s in there.

But 89 per cent admitted they dip into their savings pile, at least sometimes – to cover unexpected expenses (49 per cent) or travel (33 per cent).

It also emerged 43 per cent know there are ways their money could be working harder but just don’t know how.

While 29 per cent admitted they have a fear of financial risks, according to the OnePoll.com figures.

Flagstone’s spokesperson added: “Most people aren’t money experts.

“But the first step to earning more interest, is taking an interest.

“It’s time to wake up the UK’s savings; when every pound pays its way, savers can earn more, do more, and ultimately feel more secure.”