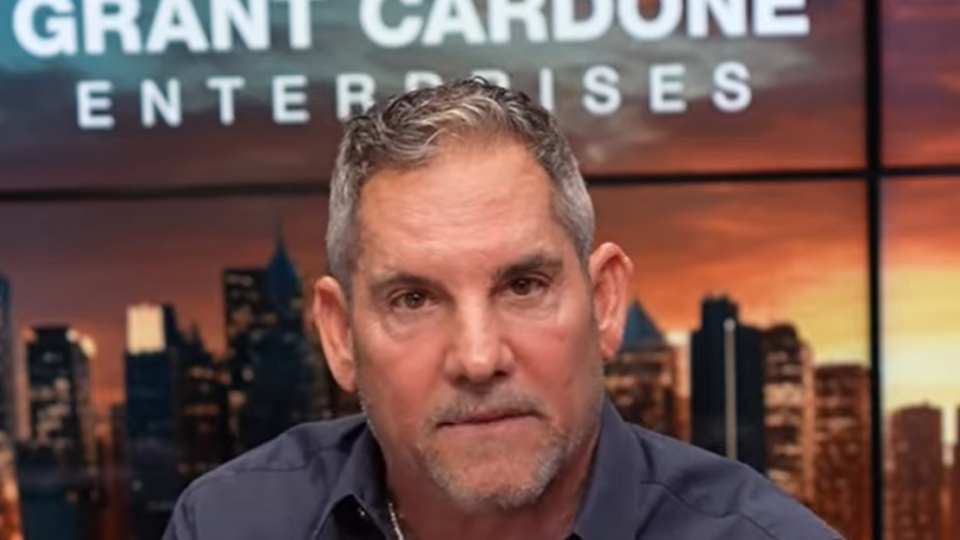

Real estate mogul Grant Cardone says owning rental properties will pay big dividends.

With soaring home prices and elevated interest rates keeping potential buyers on the sidelines, investors in rental properties are thriving.

In a post on X, Cardone noted that Gen Z prefers renting over owning a home because they value mobility and flexibility. Baby boomers are trading homeownership for rentals so they can use the equity they’ve built over the years for travel, investing and assisted living as they age.

Cardone says developing affordable housing is “unachievable” because of the high cost of labor and materials, regulations, and financing challenges. He also noted that 60% of home mortgage interest rates are at 4% or lower for 30 years, which makes it less likely that homeowners will sell. Instead, they’ll rent their homes to pay for the mortgages and other expenses.

Don’t Miss:

“Insurance is out of control with cost going to $2,500 a year vs. renters insurance policy at $180,” he wrote.

Institutional investors moved into the single-family rental market after the Great Financial Crisis, purchasing foreclosed homes in bulk at low prices. The strategy helped prevent the housing market from collapsing entirely, allowing investors to reap significant benefits. Years later, they continue to profit, but now it’s because of the increasing unaffordability of housing.

“When you think about the affordability crisis really playing out in the U.S. today, it is benefiting the rental market,” Laurel Durkay, Morgan Stanley’s head of global listed real estate assets, said in an interview with CNBC.

Trending: Warren Buffett flipped his neighbor’s $67,000 life savings into a $50 million fortune — How much is that worth today?

Responding to a comment from the show’s anchor, Durkay said, “So you had said that it was moving from the American dream to a pipe dream, that does provide opportunity for rental landlords to be able to fill this affordability gap.”

Although institutional ownership of single-family rentals is below 5% and accounts for less than 1% of all single-family homes, its impact is more significant in certain markets. For instance, in Atlanta, institutional investors own over 4% of single-family homes, pushing housing costs higher.

“I think the most attractive [investment] right now, taking everything into consideration, is going to be the single-family rental market,” Durkay said.

Keep Reading:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Grant Cardone Predicts Big Gains For Rental Property Investors Amid Soaring Home Prices originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.