Tom Slater explains why the trust has sold longstanding holding Tencent.

In a world of ongoing geopolitical tensions, shifting monetary policies and disruptive technology, companies need to be more resilient to warrant inclusion in the Scottish Mortgage investment trust, according to manager Tom Slater.

This shift in mindset led the manager, who runs the trust alongside Lawrence Burns, to sell out of Chinese technology giant Tencent over the course of the year, after having owned it for 15 years.

“The combination of a weak domestic economy, an uncertain regulatory environment and geopolitical concerns have made the inclusion criteria for Chinese stocks in the portfolio more demanding,” he said.

“We think that ongoing political and regulatory developments mean that the constraints that go with scale for Chinese businesses have increased substantially. As a result, it will be difficult for Tencent to meet our more demanding inclusion criteria over the coming years.”

That is not to say the trust has given up on Chinese companies. Far from it. Scottish Mortgage remains invested in e-commerce giant Pinduoduo and added to Meituan, the local services company, last year.

Scottish Mortgage also sold out of Illumina, the US genomic sequencing company, last year, with Slater noting the firm’s “execution could have been better”, while the work required to “drive demand and lower costs will be challenging for some time”.

The trust also sold down some of its holding in Tesla – a long-time favourite of the managers – reducing the exposure partway through the year. As a result, private equity holding SpaceX – also headed by controversial chief executive Elon Musk – has overtaken Tesla in the portfolio.

“Tesla’s recent products have been hugely successful and preliminary sales data indicate that the Model Y was the best-selling vehicle in the world last year. However, the rise in interest rates has reduced the affordability of all high-ticket items, including Tesla vehicles, depressing demand,” said Slater.

“At the same time, the rapid scaling of Chinese electric vehicle production, along with improving quality, is a powerful source of competition and pricing pressure.”

While this may be “irrelevant” to the company’s long-term investment case, due to its successful integration of artificial intelligence (AI), it was enough to encourage the managers to trim the position.

These are all examples of the managers making moves to improve the portfolio’s resiliency, with Slater highlighting the Covid-19 pandemic, supply chain disruptions, two global conflicts and an emerging cold war between the US and China as “eroding trust” in the economy.

“People are more uncertain about trade agreements, financial structures, democratic provisions, the reasonableness of judicial decisions, and the dependability of public health provisions. This feeling of instability makes the idea of rational decision-making less reliable,” he said.

As a result, the pace of globalisation is slowing, or even in reverse, with countries moving production back to their own shores. This has been evident in the chipmaker sphere, where the US passed the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, as well as in Europe, where the EU has brought energy production back from Russia following its invasion of Ukraine.

“This economic shift is a major adjustment after a long period of relative stability post-World War II. It’s unclear when, or even if, the previous stability will return,” said Slater.

As such, the managers are “placing greater emphasis on resilience” as adaptability is “a crucial attribute in a world of uncertainty”.

“It is a multifaceted quality with financial components, such as high margins or strong balance sheets, and cultural elements that are equally important. Diverse organisations are more likely to contain the ingredients for success in a shifting environment than are monocultures,” he said.

“This change in emphasis doesn’t diminish our focus on imagining what a company will look like 10 years from now. It is an acknowledgement that businesses must face challenges in the interim as they exist today.”

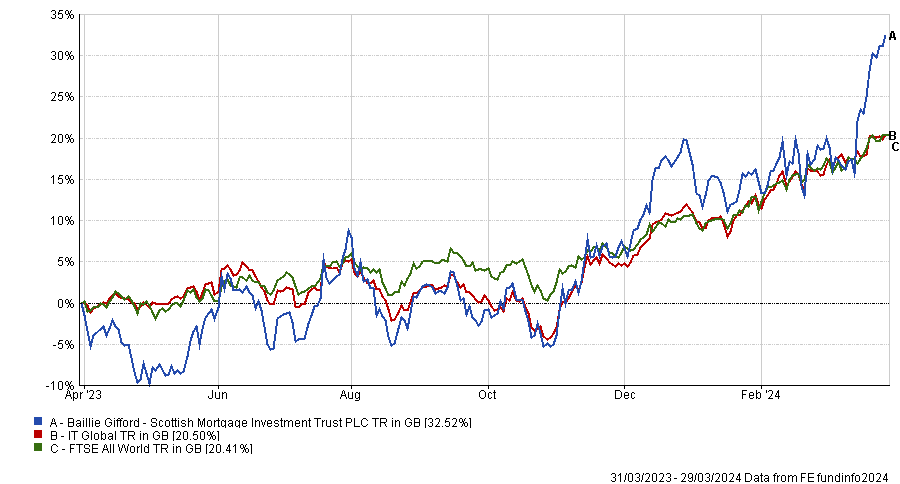

The manager made these comments in the trust’s annual results, during which time it made an 11.5% net asset value (NAV) total return. With share price gains taken into account, the trust rose 32.5%, thanks to its buyback scheme, which encouraged the share price discount to tighten from 19.6% to 4.5%.

Performance of trust over 1yr

Source: FE Analytics

Following the results, Ewan Lovett-Turner, head of the investment companies research team at Numis Securities, said: “We believe Scottish Mortgage deserves a place in almost every portfolio and has the potential to deliver strong returns over the long-term, although as recent years have demonstrated, it is never likely to be a smooth ride.”

He added that the shares closed yesterday on a discount of 10%, which “offers significant value” to those buying now.