Price reductions of existing homes jump to 31.7% of active listings, highest since 2017.

By Wolf Richter for WOLF STREET.

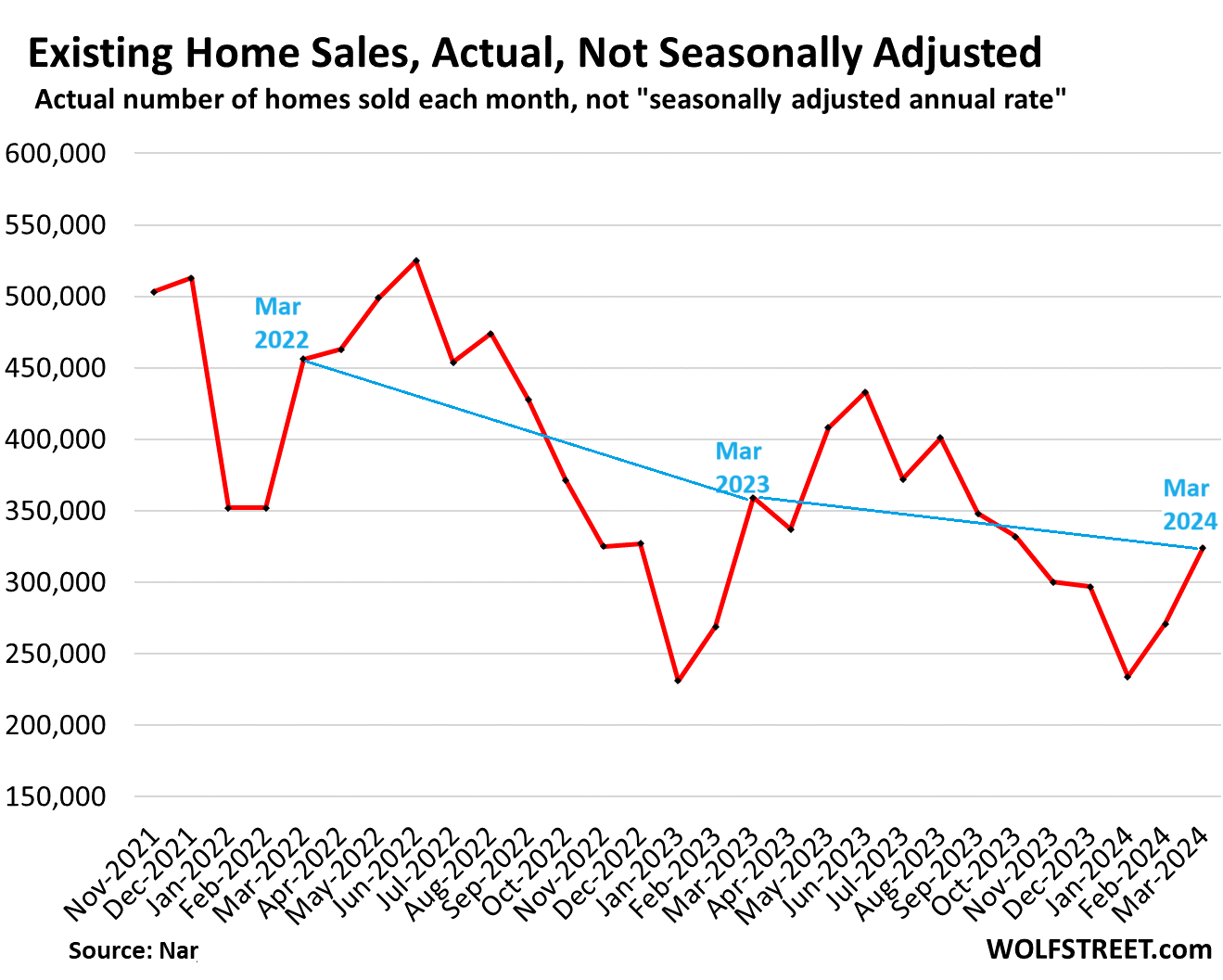

Sales of existing homes always jump from February to March. And closed sales rose this March as well but not nearly as much as they normally rise in March, and year-over-year they were down again, and month-to-month on a seasonally adjusted basis, sales also fell.

Actual sales, not seasonally adjusted, rose to 324,000 homes in March, according to data from the National Association of Realtors (NAR) today. This was down by 9.7% from March 2023 and by 28.9% from March 2022:

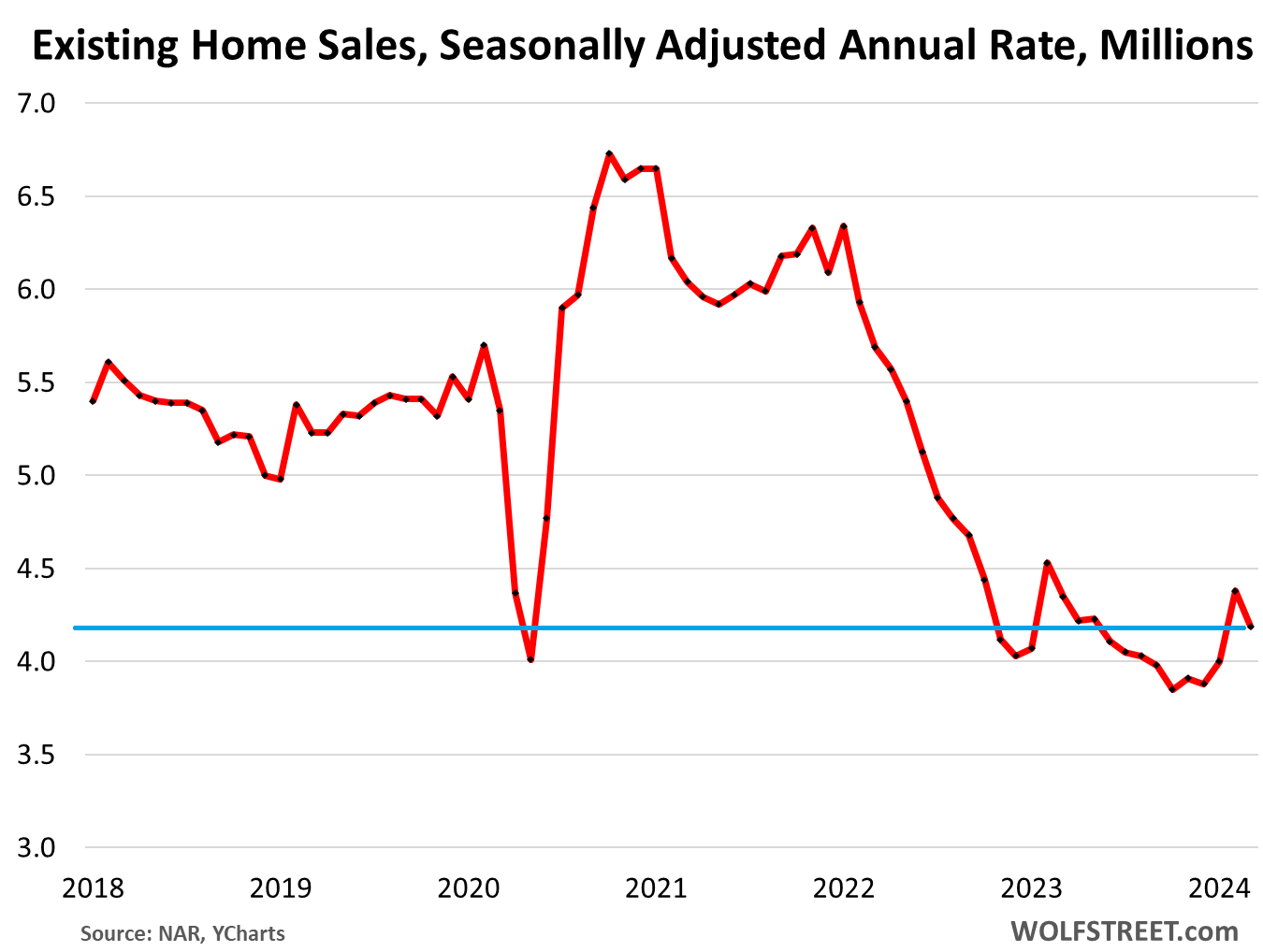

The seasonally adjusted annual rate of sales fell by 4.3% in March from February, to an annual rate of 4.19 million sales.

Down from March in prior years (from the prepandemic Marches in bold):

- March 2023: -3.7%

- March 2022: -26.4%

- March 2021: -30.6%

- March 2019: -19.9%

- March 2018: -24.0%.

Home sales remain at crushed levels as the entire housing market has shrunk by about 20% because homeowners with 3% mortgages are neither buying nor selling, and have vanished as demand, and have vanished in equal number as supply, and due to them, sales are down and supply is down in equal measure, and so churn is down. Realtors are fretting about the drop in market volume because they make commissions off the churn. And for Realtors, this situation is really bad.

The seasonally adjusted annual rate of sales in October, November, and December last year had been the lowest since the worst months of the Housing Bust in 2010: (historic data via YCharts):

Active listings rose to the highest level since before the pandemic, to 695,000 active listings in March, according to data from Realtor.com. Compared to March in prior years:

- March 2023: +23.5% (green)

- March 2022: +96.3% (black)

- March 2021: +57.7% (yellow)

- March 2019: -37.7% (purple)

- March 2018: -34.9% (brown)

New listings rose by 16.6% from the prior month and by 15.6% from a year ago, and were down 17.2% from March 2019, according to data from Realtor.com.

But since sales have dropped off even more (-19.9% since March 2019, see above) than new listings, active listings continued to build. This growth in new listings and the sharp drop in demand is what is fueling the continued growth in active listings.

Remember, this entire market – demand and supply – has shrunk by about 20% as the 3% mortgage holders have left the market both as buyers and as sellers in equal number (data via Realtor.com):

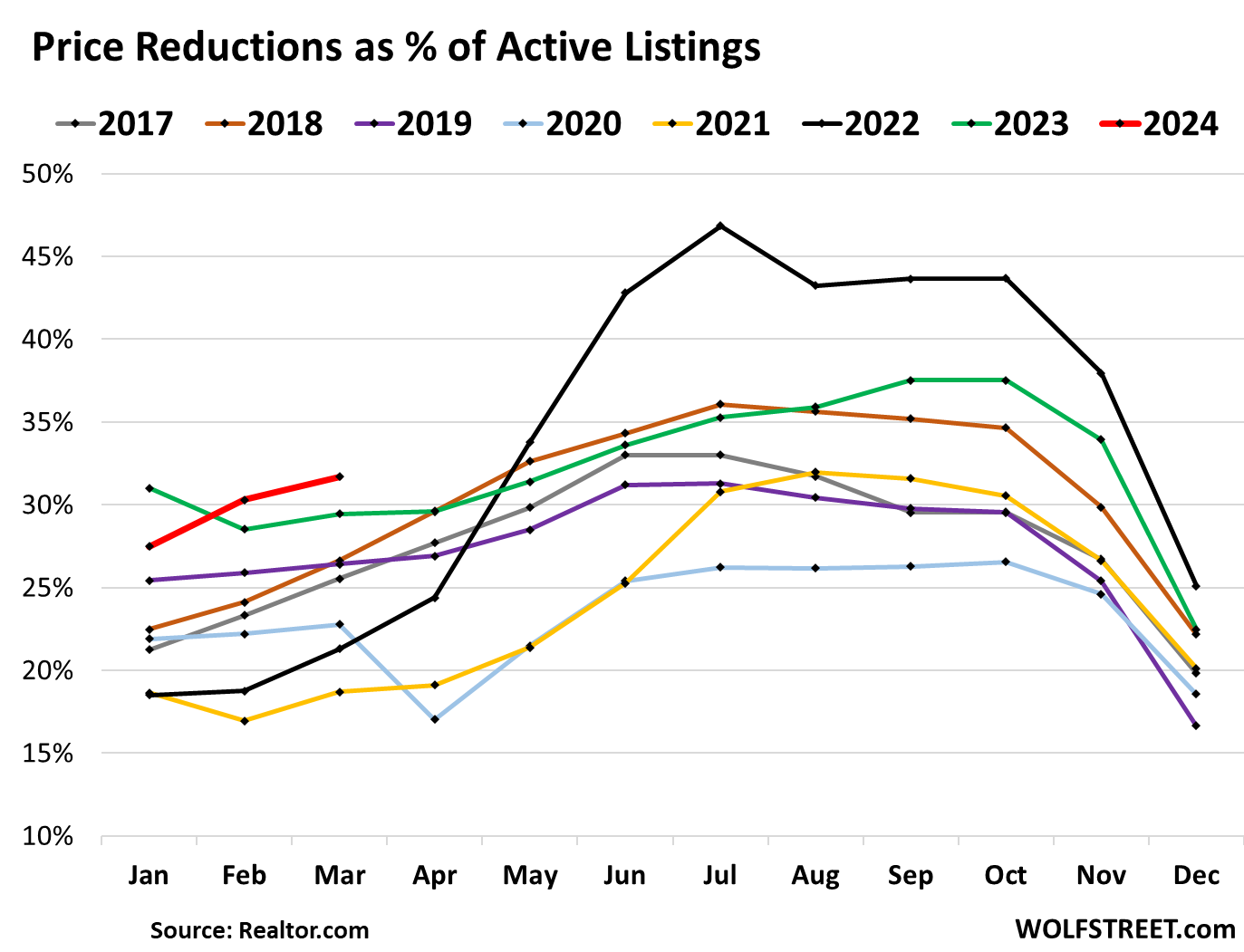

Price reductions jumped to 31.7% of active listings, the highest for any March in the data released by Realtor.com going back through 2017. It indicates that sellers are grappling with reality and are trying to make deals:

The commercial real estate (CRE) market has started figuring this out two years ago, and massive repricing is underway across the board. But with homeowners, it’s a much slower process apparently.

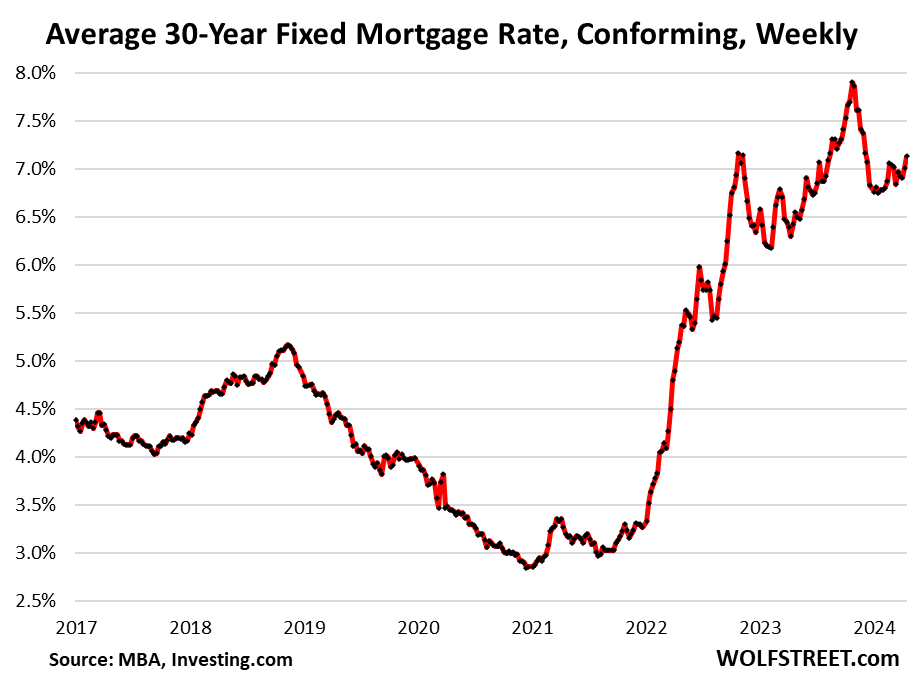

Clearly, many sellers are still trying to cling to prices that are too high, and buyers are not biting with the same gusto of two years ago. Now, mortgage rates have gone back to what were historically-speaking — before the money-printing era commenced in 2008 — normal-ish rates of around 7%. And that brief Rate-Cut Mania dip in mortgage rates is reversing:

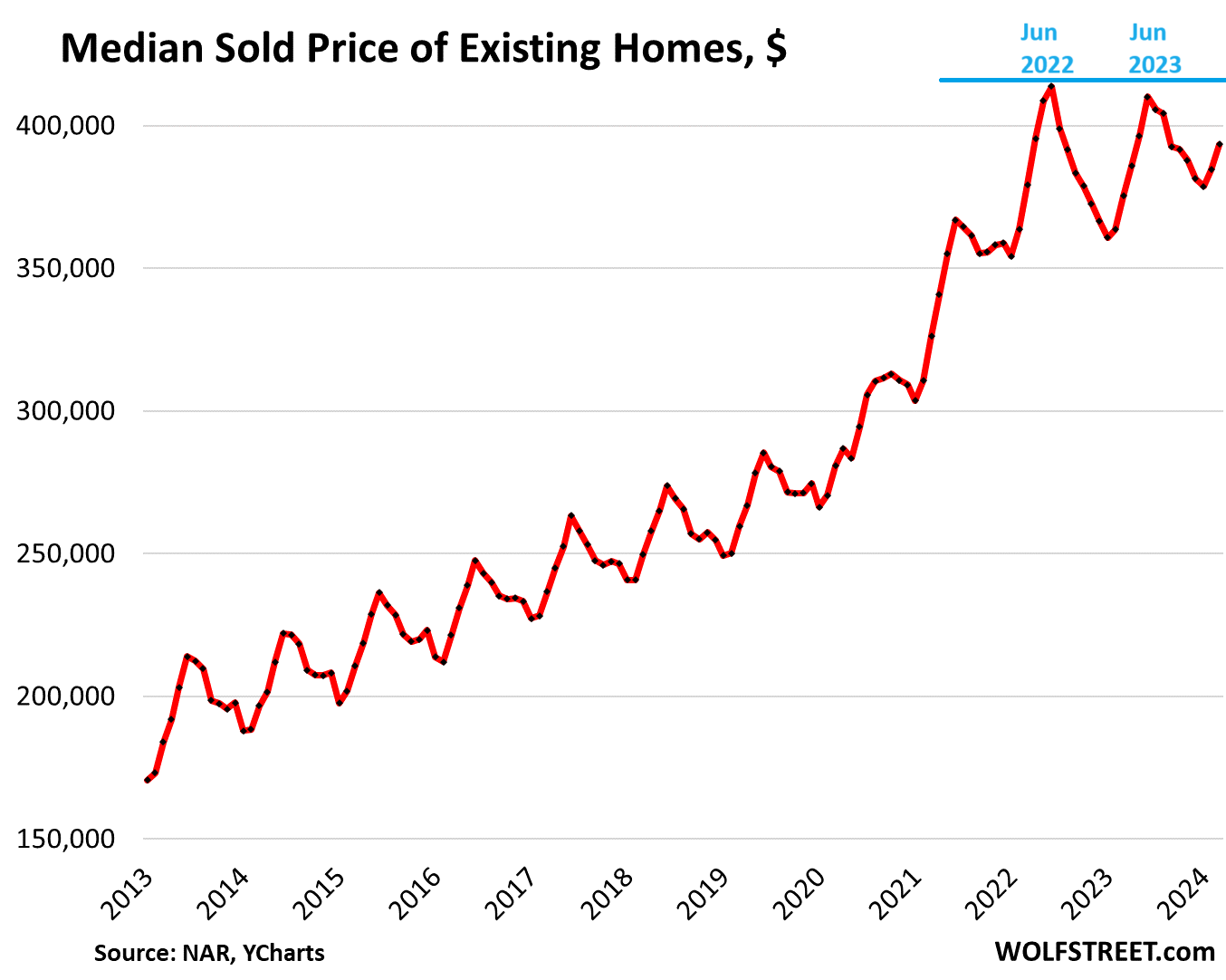

The national median sold price in March rose to $393,500. The very seasonal median price nearly always increases strongly in March from February. But this March, the month-to-month increase of 2.3% was the smallest increase for any March going back to the Housing Bust. The average month-to-month increase in March from 2012 through 2023 was 4.2%.

This much smaller than normal increase in March caused the year-over-year increase to get whittled down to 4.8% in March, from 5.7% in February.

From the peak in June 2022, the national median price was down 4.9%

The year 2023 was the first year since the Housing Bust when the seasonal high in June was lower than the seasonal high and all-time high a year earlier (historic data via YCharts):

Supply jumped to 3.2 months, the highest for any March since March 2020 (3.3 months).

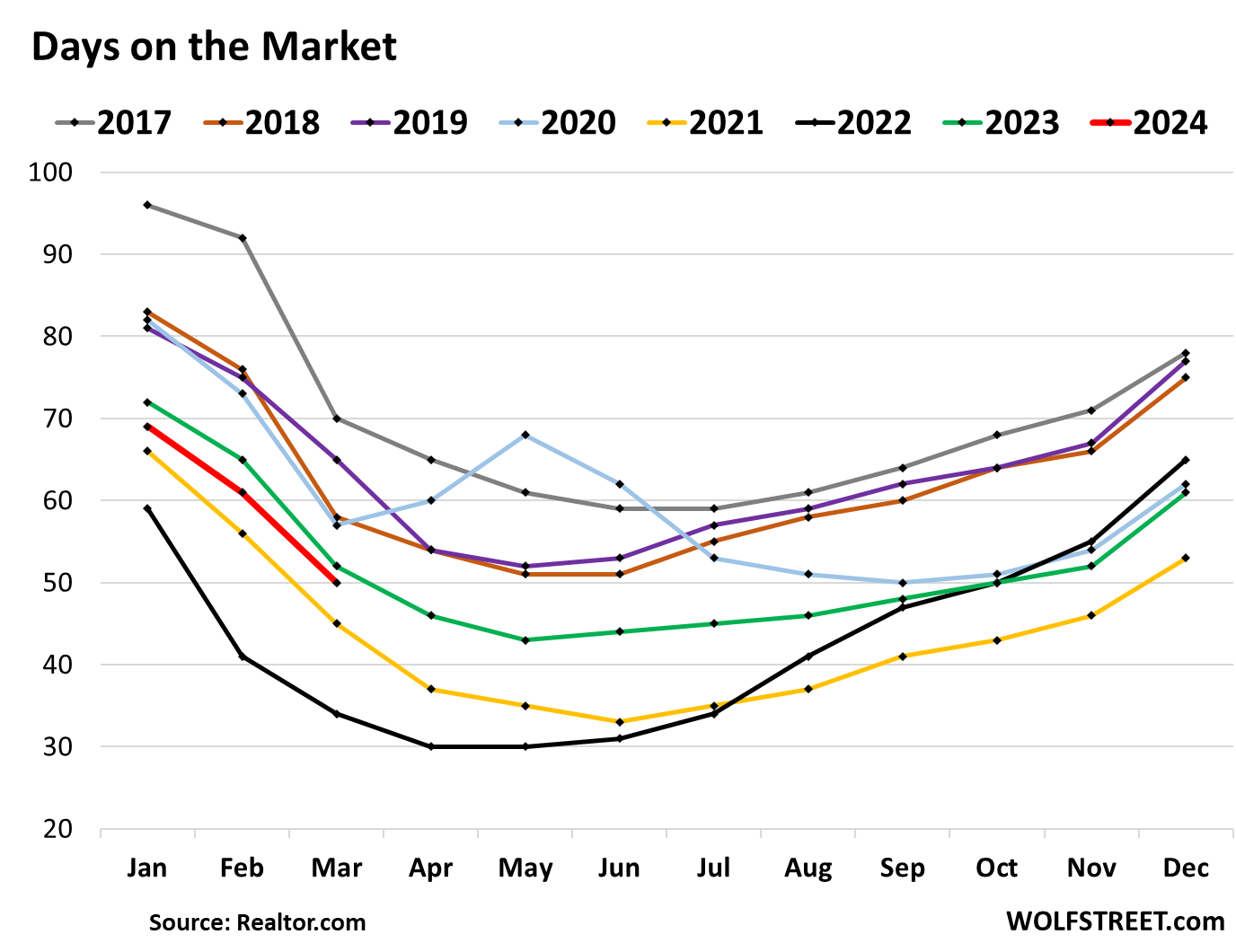

Days on the market – until the home is either sold or pulled off the market – followed seasonal patterns and declined to 50 days in March, down 2 days from March 2023 (52 days) and up from March 2022 (45 days) and from March 2021 (34 days). This metric is a function of both, how quickly a home sells, and how quickly it gets pulled off the market without selling.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()