- ONS data shows how each area has been hit by rising mortgages and rent costs

Rising mortgage and rent costs faced by Britons have been laid bare by new data showing how each area is vulnerable to swings in the housing market.

The Office for National Statistics (ONS) has compiled figures for each council area in England and Wales which shows how exposed homeowners and renters are to rising costs.

The data shows London residents were most likely to be hit by rising mortgages and rents, with Kensington & Chelsea topping both lists, with average monthly mortgage payments rising by £1,193 (30%) from £3,907 to £5,100 from 2022 to 2023. Renters in the borough did not fare much better, with average monthly rents rising nearly by £273 (10%) from £2,757 to £3,030.

But Blaenau Gwent in Wales has seen the lowest rise in mortgage rates, with an average increase of £68 (21%) from £317 to £386 a month.

Housing costs have seen a sharp rise since 2022 amid rocketing inflation and higher interest rates. Renters in the area saw a £55 a month rise (11%) from £484 to £539.

In the year to October 2022, inflation reached a 40-year-high, according to the Consumer Prices Index including owner occupier housing costs. In response, the Bank of England gradually raised the Bank Rate from 0.1 per cent to 5.25 per cent between winter 2021 and summer 2023.

More than 1.4million households in the UK had fixed-term mortgages due for renewal in 2023, with more than half coming off interest rates of less than 2%. By the end of 2023, more than a third of those responsible for rent or mortgage payments in Great Britain were struggling to afford them, according to a survey by the ONS.

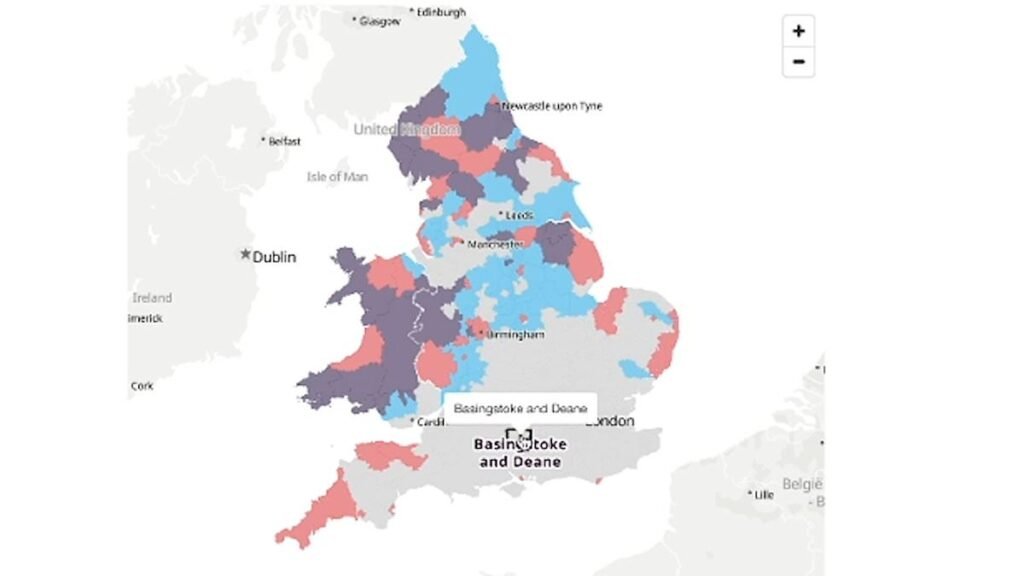

The ONS have created the tool below which explores which areas of England and Wales have been most and least exposed to rising mortgage and rent costs during 2023. The statistics agency has assigned each area an exposure score relative to other local authorities based on two measures:

- The estimated proportion of households affected by rising costs.

- The increase in costs as a proportion of estimated disposable income for the average household.

To use the ONS tool below, select your area below and you will see maps, charts and analysis showing how housing costs are estimated to have risen in 2023, and a comparison with other areas: