The fastest growing group of people taking out mortgages lasting into retirement is those aged under 40, many of whom are first-time-buyers.

There is a risk that these groups will not be able to afford to service a mortgage once they retire and will raid their pension savings to clear their mortgage, leaving them with less to live on in old age.

The data, obtained by Steve Webb, partner at pension consultants LCP, was based on mortgage data supplied by the FCA to the Bank of England.

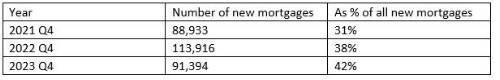

Table 1 shows the number and percentage of new mortgages in Q4 of each year which ran past state pension age.

Table. Number and share of new mortgages with term end beyond state pension age

Multiplying the quarterly figures by four to get annual figures, this suggests that over the last three years over 1 million new mortgages have been issued with end dates beyond state pension age.

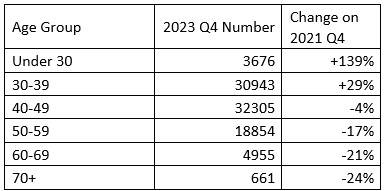

Table 2 shows the number of people in each age group in 2023 Q4 taking out mortgages which run past pension age and how that number has increased over the previous two years.

Table 2 shows that in the key group of people in their 30s, mostly taking their first step on the housing ladder, there has been a 29% increase in the absolute number taking out new mortgages which run on past pension age. This is likely to be in response to the unaffordability of house purchase for many younger people

Separate information supplied by the Bank of England shows that just under a quarter (23%) of new mortgages to people in their thirties ran past pension age but now it is around 2 in 5 (39%).

Although a mortgage taken out in someone’s thirties, perhaps as a first time buyer, is highly unlikely to be someone’s last mortgage, the risk to retirement depends on what happens over the course of their working life and whether or not they are able to shorten the term.

Particular concerns are:

a) Those who have mortgage debt at retirement may use their modest auto enrolment pension pots to clear the debt, leaving little for retirement itself and jeopardising their later life standard of living;

b) In the past, when people mostly paid off their mortgage before pension age, they could spend their final years in work boosting their pension pot. Even if mortgages only run to pension age (and not beyond), it deprives people of a period pre-retirement when they might have paid off their mortgage and be able to boost their pension;

c) Mortgage lenders can have little certainty as to the future pension income of someone in their thirties today, so cannot know if borrowers will have enough income in retirement to service a mortgage debt.

d) Growing numbers of people have dropped out of the labour market *before* reaching pension age which puts extra pressure on keeping up payments on a long-term outstanding mortgage;

Commenting, Steve Webb, partner at pension consultants LCP said: The huge number of mortgages which run past state pension age is shocking. The challenge of getting on the housing ladder is forcing large numbers of young home buyers to gamble with their retirement prospects by taking on ultra-long mortgages. We already know that millions of people are not saving enough for their retirement and if some of that limited retirement saving has to be used to clear a mortgage balance at retirement they will be at even greater risk of poverty in old age. Serious questions need to be asked of mortgage lenders as to whether this lending is really in the borrower’s best interests”.