It’s a relatively small survey but figures from Clifton Private Finance provide a snapshot of some sentiments prevailing in the property market.

Over 500 people responded to the firm’s website survey between last November and March 2024. Questions included topics surrounding mortgage rates, mortgage repayments, house price trends, the housing crisis debate, and each participant’s annual income for comparative data.

The results are published in the firm’s Mortgage Pulse Report 2024.

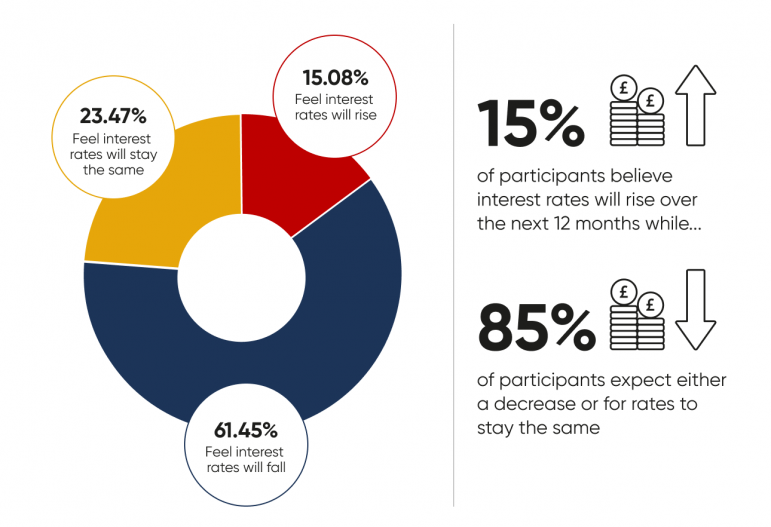

Over 85% of the responses do not think interest rates will rise in 2024.

Finance broker, Carly Cheeseman said, “Firstly, interest rates have already significantly improved over the last 8-12 weeks, which is good news for borrowers. But I’d expect the base rate to stay the same until around springtime next year, at which point we may see a reduction.

“Any sooner than that and there could be uproar from the public. Many people fixed their mortgages around the 6% mark for 5 years – so seeing the base rate go back down so quickly after so many consecutive hikes would be a hard pill to swallow.

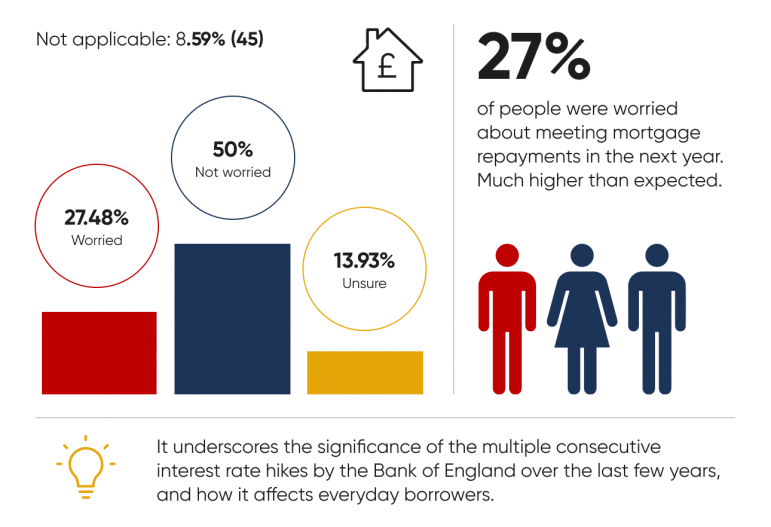

1 in 3 are worried about keeping up with their mortgage payments

Cheeseman commented: “Mortgage repayments are going to pretty much go up for everybody. This year, lots of people came off 2-year fixes and saw an extreme spike in their repayments. But over the next 2-3 years I think the spikes will be lower because the rates will settle a little bit – I think we’ve seen the peak.”

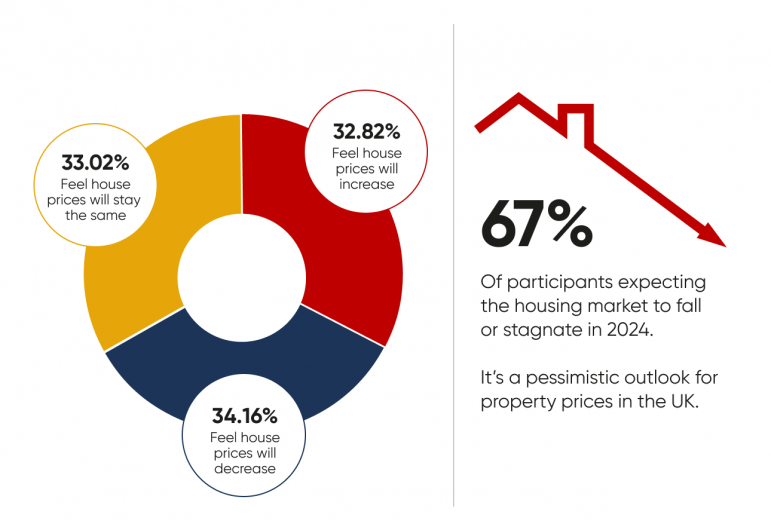

Three out of four people don’t think house prices will increase in 2024.

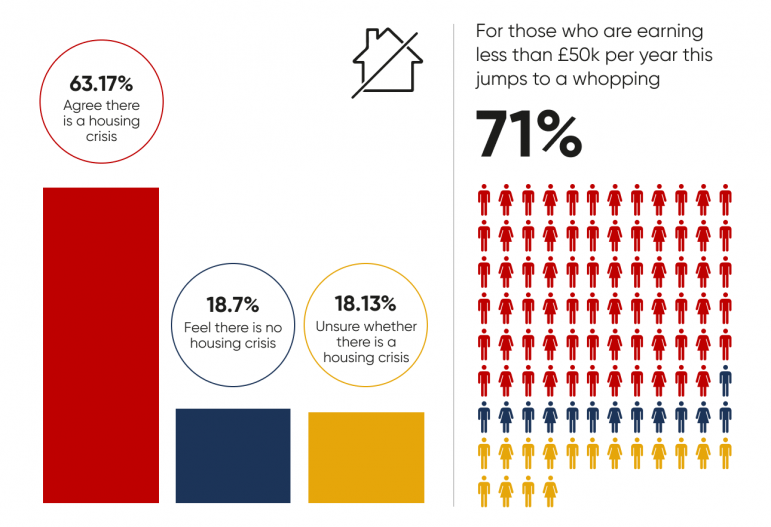

In Cheeseman’s view, “I don’t think we’ll see a significant drop in house prices over the next 12 months – perhaps just a small decrease next year. In terms of the housing crisis debate – we’re certainly short of affordable properties in the UK.”

Clifton Finance acknowledges that this is a subjective and divisive topic but says the numbers speak for themselves – Over 60% of participants think the UK is facing a housing crisis – and for those earning under £50k a year the percentage rises to 71%.